Customer relationship management (CRM) software is a powerful tool for financial services organizations looking to better serve existing customers and grow their client bases. From supporting sales and marketing efforts to offering more personalized customer support, CRM is invaluable for businesses from banks to insurance companies. Below, we outline some of the most important ways CRM is transforming operations and growth for the financial services industry.

Improve Marketing

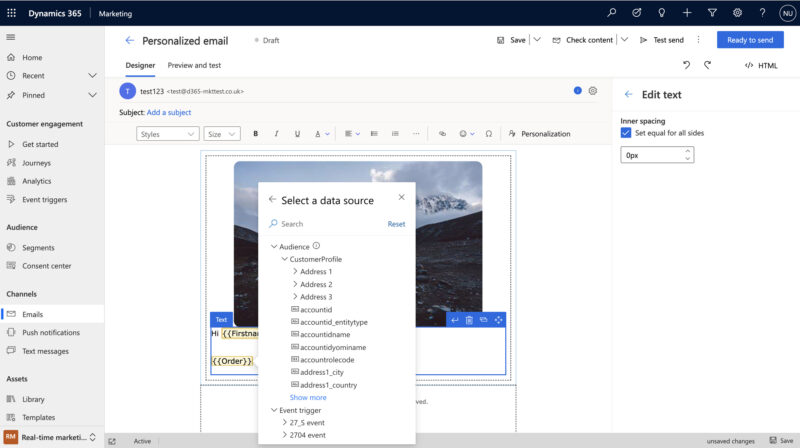

The more data you have about your ideal target customers, the stronger your marketing efforts. CRM solutions help you learn more about your customers based on their interactions with your organization, their demographics, their interests, and more. The technology enables you to better identify what services are likely to appeal to them and to tailor your marketing campaigns accordingly. You can personalize marketing content and use CRM to put customers on certain marketing campaigns to specifically target their exact needs. CRM also tracks these efforts so you can gain insight into what’s working and what’s not.

Improve Sales

It follows that better marketing leads to better sales, and this equation is certainly true if a financial services organization uses CRM. The technology helps you monitor customers who are in your pipeline to usher them further down the sales funnel, and it also tracks existing clients so you can upsell to them at the right moments. Through automation, CRM helps your sales team streamline contact management, forecasting, outreach, and more. Sales work like sending follow-up emails can be done automatically. You can also use CRM to track the performance of your sales employees so you can make decisions about how to improve.

Deliver Better Customer Support

When customers need in-person help, a CRM solution can help guide your representatives while assisting them. The technology hosts all customer information in one place, so reps spend little-to-no time searching for records of transactions or other history. Natural language processing can also take notes about the customer’s call in real time. Additionally, CRM offers the ability to connect with customers on any channel they prefer—from text to email to phone and more. Financial services companies can leverage this solution to offer superior customer support experiences.

Ensure Compliance and Data Security

Financial services organizations have some of the most rigorous industry regulations to abide by, and CRM helps you stay compliant with them. The solution stores your sensitive data in a centralized hub, and you can set permissions for who has access to what information. With encryption, access controls, and document management, your customer data remains safe. Retrieving information is easy in the system, and you can automate reporting features to further support compliance efforts. The system also provides clear audit trails so you can demonstrate accountability during an investigation. Instances of changing client information are tracked by CRM’s version tracking capabilities so you have data to present should a dispute occur.

Explore CRM for Financial Services with the Right Implementation Partner

Many CRM solutions out there claim to be do-it-yourself or easy to install with a modicum of IT knowledge, however the truth is that any financial services organization will need an implementation partner to do it right. Opting for self-implementation runs risks that financial institutions can’t afford, such as errors with transferring data or not getting the most ROI out of the solution. The right partner will set a healthy technical foundation for your CRM so you can start maximizing sales and marketing right away to boost your bottom line.

Point Alliance is well-versed in helping financial services companies take advantage of this powerful technology. Get in touch with the CRM experts at Point Alliance today.